Governor Josh Shapiro of Abington Township announced yesterday that the new Working Pennsylvanians Tax Credit (WPTC) will deliver $193 million in tax relief to 940,000 working Pennsylvanians beginning next tax season.

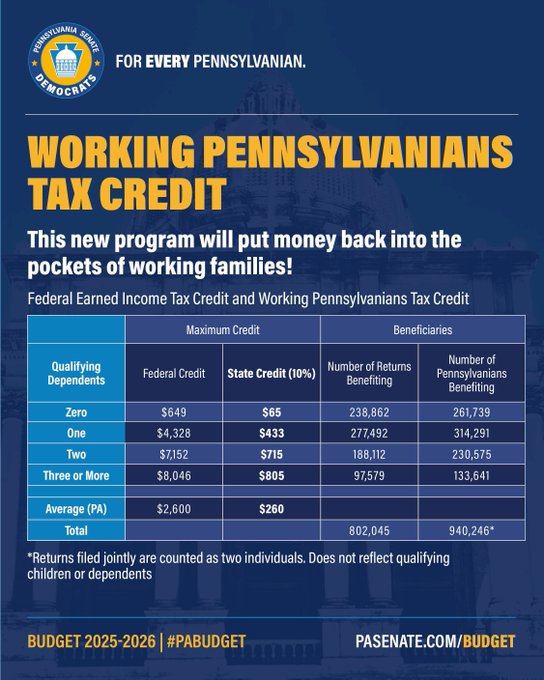

Created in the 2025–26 budget the Governor signed last week, the new credit equals 10 percent of the federal credit and is modeled after the federal Earned Income Tax Credit (EITC). Anyone who qualifies for the federal EITC will now automatically receive both credits, officials said.

“From day one, I’ve made cutting taxes and lowering costs for working families a top priority,” said Governor Shapiro. “Pennsylvanians are feeling the impact of rising costs, and while federal policies have only made that harder, my Administration is focused on cutting taxes and helping working families get ahead. This new Working Pennsylvanians Tax Credit will put up to $805 back in the pockets of hardworking Pennsylvanians, giving them more resources to support their families.”

When Pennsylvanians file their federal and state taxes, the Pennsylvania Department of Revenue will automatically calculate the state credit. A single working parent with three children earning $23,300 will receive the maximum of $805 from the state credit, and a married couple with three children making $60,000 will receive $183 from the state credit.

More details here and below: