Pennsylvania Department of Revenue Secretary Pat Browne is encouraging residents to take advantage of the new and expanded Working Pennsylvanians Tax Credit (WPTC), which eligible taxpayers can now claim.

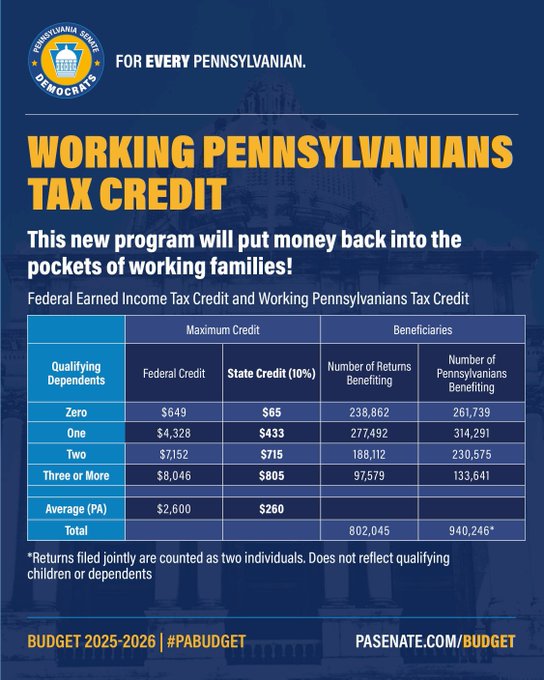

Modeled after the federal Earned Income Tax Credit (EITC), the WPTC equals 10 percent of the federal credit and can provide up to $805 in tax relief. The credit is expected to deliver $193 million in tax savings to approximately 940,000 Pennsylvanians this year.

When Pennsylvanians file their federal and state taxes, the Pennsylvania Department of Revenue will automatically calculate the state credit. A single working parent with three children earning $23,300 will receive the maximum of $805 from the state credit, and a married couple with three children making $60,000 will receive $183 from the state credit.

According to yesterday’s press release, anyone who qualifies for the federal EITC automatically qualifies for the state credit.

In related news, the Child and Dependent Care Enhancement Tax Credit has been expanded. Eligible families can receive between $600 and $2,100, depending on income level and number of dependents.

“Governor Shapiro led the charge last year to create the Working Pennsylvanians Tax Credit and two years ago to significantly expand the Child and Dependent Care Enhancement Tax Credit — both of which will deliver real, meaningful relief to hardworking Pennsylvanians and their families when they file their tax returns this tax season,” said Secretary Browne. “We want Pennsylvanians to know these credits are available and that we offer free, user-friendly tools to help them claim every dollar they’re eligible for before the April 15 filing deadline.”

The WPTC was created in the 2025–26 budget and first announced in November. You can check your eligibility and use the WPTC calculator to estimate your credit here.